New Chandigarh Medicity: How 300-Acre Healthcare Hub Will Transform Property Prices

- Tanmay Mehta

- Aug 28, 2025

- 7 min read

Updated: Sep 11, 2025

Contents

The Healthcare Revolution Begins

Dr. Priya Mehta, a cardiac surgeon from AIIMS Delhi, recently invested ₹1.2 crores in a 3BHK apartment just 2 km from the upcoming New Chandigarh Medicity. Her decision wasn't just about convenience – it was a calculated investment move. With 15 world-class hospitals and a 500-bed medical college planned within the New Chandigarh Medicity overview, properties in the vicinity are projected to appreciate by 80-100% over the next five years.

The New Chandigarh Medicity represents more than just healthcare infrastructure – it's a complete ecosystem transformation that will create North India's largest medical hub. Spanning 300 acres with a ₹2,000 crore investment commitment, this project will reshape property dynamics across the entire region.

Industry experts compare this development to Gurgaon's transformation in the early 2000s, where strategic infrastructure projects created millionaire investors overnight. The difference? New Chandigarh's Medicity offers the same opportunity at a fraction of Gurgaon's current prices, making it accessible to a broader range of investors.

Medicity Master Plan: What's Coming

Healthcare Infrastructure Scope

Phase 1 (2025-2027):

5 multi-specialty hospitals (200-300 beds each)

Emergency trauma center with helicopter landing pad

Outpatient diagnostic centers

Pharmaceutical retail hub

Phase 2 (2027-2029):

Medical college with 500-bed teaching hospital

Research and development facilities

Specialized cancer treatment center

Cardiac and neuroscience institutes

Phase 3 (2029-2031):

5 additional specialty hospitals

Medical equipment manufacturing units

International patient care facilities

Wellness and rehabilitation centers

Employment and Economic Impact

The Medicity will directly employ over 50,000 healthcare professionals, creating unprecedented demand for residential properties. Supporting industries – pharmaceuticals, medical equipment, hospitality, and education – will generate an additional 75,000 jobs in the ecosystem.

Key Employment Categories:

Doctors and specialists: 8,000+ positions

Nursing and paramedical staff: 25,000+ positions

Administrative and support staff: 17,000+ positions

Research and pharmaceutical professionals: 5,000+ positions

This employment surge translates directly into housing demand, particularly for quality residential property for sale in New Chandigarh within commuting distance of the medical hub.

Investment Impact Analysis

Property Appreciation Projections

Distance-Based Impact Analysis:

0-2 km from Medicity:

Current average price: ₹5,500-7,000 per sq ft

Projected 5-year appreciation: 100-150%

Expected price by 2030: ₹11,000-17,000 per sq ft

2-5 km from Medicity:

Current average price: ₹4,500-6,000 per sq ft

Projected 5-year appreciation: 70-100%

Expected price by 2030: ₹8,000-12,000 per sq ft

5-10 km from Medicity:

Current average price: ₹3,500-5,000 per sq ft

Projected 5-year appreciation: 50-80%

Expected price by 2030: ₹5,500-9,000 per sq ft

Rental Yield Enhancement

Healthcare professionals typically seek quality housing with modern amenities, driving premium rental rates:

Current Rental Yields (Pre-Medicity):

2BHK apartments: 6-7% annually

3BHK apartments: 5-6% annually

Independent houses: 7-8% annually

Projected Rental Yields (Post-Medicity Phase 1):

2BHK apartments: 9-11% annually

3BHK apartments: 8-10% annually

Independent houses: 10-12% annually

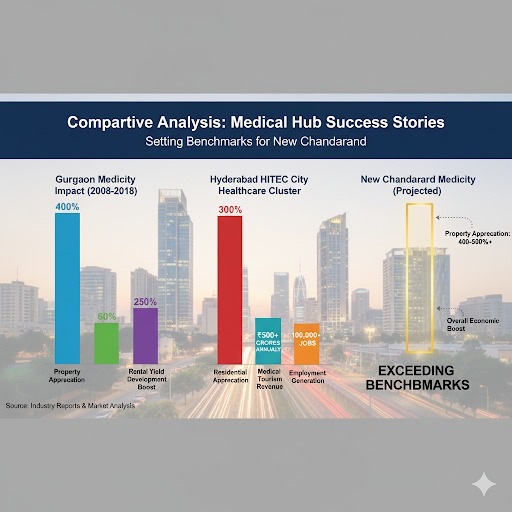

Comparative Analysis: Medical Hub Success Stories

Gurgaon Medicity Impact (2008-2018):

Property appreciation: 300-400%

Rental yield improvement: 40-60%

Commercial development boost: 250%

Hyderabad HITEC City Healthcare Cluster:

Residential appreciation: 200-300%

Medical tourism revenue: ₹500+ crores annually

Employment generation: 100,000+ jobs

New Chandigarh's Medicity, with superior planning and infrastructure, is positioned to exceed these benchmarks.

Best Properties Near Medicity

Premium Residential Options

The strategic location near Medicity makes certain developments particularly attractive for both investment and end-use. Consider exploring all projects in New Chandigarh to understand the complete opportunity landscape.

Eco City Phase 1 - Green Medical Community

Distance from Medicity: 1.5 km Investment Highlights:

Price Range: ₹65 lakhs to ₹1.8 crores

Green Advantage: Sustainability features appeal to health-conscious professionals

Amenities: Clubhouse with gym, yoga center, and wellness facilities

Appreciation Potential: 120-150% over 5 years due to proximity and eco-friendly positioning

Eco City 1 overview reveals why this development is perfectly positioned to benefit from the medical hub's growth. The project's emphasis on wellness and sustainability aligns with healthcare professionals' lifestyle preferences.

Omaxe The Lake - Luxury Living for Medical Professionals

Distance from Medicity: 3.2 km Investment Highlights:

Price Range: ₹75 lakhs to ₹2.2 crores

Unique Appeal: Lakefront living provides stress relief for high-pressure medical careers

Infrastructure: Private healthcare clinic planned within the township

Target Market: Senior doctors, hospital administrators, medical college faculty

The Omaxe The Lake apartments offer a perfect combination of luxury and convenience for medical professionals seeking premium housing near their workplace.

DLF Hyde Park - Established Township Advantage

Distance from Medicity: 4.8 km Investment Highlights:

Price Range: ₹85 lakhs to ₹2.5 crores

Proven Track Record: 40% appreciation since launch, additional boost expected from Medicity

Complete Infrastructure: Schools, retail, and healthcare facilities already operational

Investment Security: DLF's reputation ensures consistent demand

DLF Hyde Park plots and apartments provide immediate living solutions for medical professionals relocating for Medicity opportunities.

Budget-Friendly Options

Ambika Group Developments

Distance from Medicity: 2-6 km across various projects Investment Highlights:

Price Range: ₹35 lakhs to ₹1.2 crores

Variety: Plots, independent floors, and apartment options

Flexibility: Multiple locations at different distances from Medicity

Growth Potential: Early-stage pricing with maximum appreciation opportunity

Ambika Group properties offer diverse options for different investment strategies near the medical hub.

Riseonic and SBP Projects

Budget Range: ₹28 lakhs to ₹80 lakhs Target Audience: Junior doctors, nursing staff, paramedical professionals Investment Logic: Affordable housing shortage near medical facilities creates strong rental demand

These projects cater to the large workforce that will support Medicity operations, ensuring consistent occupancy and rental growth.

Commercial Opportunities

The Medicity will create substantial demand for supporting commercial infrastructure, opening multiple investment avenues beyond residential properties.

Medical Retail and Clinic Spaces

Investment Opportunity: Medical retail & clinics space

High-Demand Commercial Categories:

Pharmacy and medical stores

Diagnostic laboratories

Physiotherapy and rehabilitation centers

Medical equipment showrooms

Health insurance offices

Expected Returns:

Rental yields: 12-18% annually

Capital appreciation: 150-200% over 5 years

Occupancy rates: 95%+ due to essential nature

Hospitality and Service Sector

Hotel and Guest House Opportunities:

Medical tourism accommodation

Families of patients requiring extended stays

Visiting doctors and medical professionals

Conference and training facilities

Investment Metrics:

Room rates: ₹3,000-8,000 per night

Occupancy rates: 70-85% average

ROI timeline: 6-8 years

Food and Beverage Outlets

Strategic Locations:

Hospital campus food courts

Residential complex retail spaces

Highway-facing restaurants

24x7 cafeterias for shift workers

Timeline and Development Phases

Phase 1: Foundation (2025-2027)

Infrastructure Development:

Site preparation and basic utilities

Access roads and parking facilities

Emergency services setup

Initial hospital construction

Investment Strategy:

Best Time to Buy: NOW (pre-construction pricing)

Target Properties: Within 5 km radius

Expected Price Impact: 30-50% increase by phase completion

Phase 2: Core Operations (2027-2029)

Operational Milestones:

First hospitals become operational

Medical college admissions begin

Healthcare professionals start relocating

Supporting businesses establish operations

Investment Strategy:

Property Demand: Peaks during this phase

Rental Market: Premium rates established

Commercial Opportunities: Maximum potential realized

Phase 3: Ecosystem Maturity (2029-2031)

Complete Development:

All planned hospitals operational

Research facilities attracting international collaboration

Medical tourism fully established

Supporting infrastructure mature

Investment Strategy:

Capital Appreciation: Maximum gains realized

Exit Opportunities: Optimal for profit booking

Reinvestment: Consider expanding to adjacent areas

Expert Investment Strategy

Portfolio Allocation Recommendations

Conservative Investor (₹50 lakhs - ₹1 crore budget):

70% residential property within 3-5 km of Medicity

30% commercial/retail space in supporting areas

Focus on established developers with proven track records

Aggressive Investor (₹1 crore+ budget):

40% premium residential near Medicity

40% commercial opportunities (medical retail, hospitality)

20% land banking in Phase 3 expansion areas

First-Time Investor (₹25 lakhs - ₹50 lakhs budget):

Single residential property 5-7 km from Medicity

Focus on 2BHK configurations for optimal rental demand

Consider emerging developers offering better pricing

Risk Mitigation Strategies

Due Diligence Essentials:

Verify RERA approvals and project timelines

Confirm infrastructure connectivity commitments

Validate developer financial stability

Check proximity to planned hospital locations

For detailed guidance, consult our comprehensive property buying guide before finalizing any investment.

Market Entry Timing

Immediate Action Required (2025):

Pre-construction pricing still available

Limited inventory in prime locations

Government incentives for early investors

Infrastructure development confirming viability

Price Escalation Timeline:

2025: Current baseline prices

2026: 20-30% increase as construction accelerates

2027: 50-70% increase as first hospitals near completion

2028: 80-100% increase as operations commence

FAQs

Q1) When will New Chandigarh Medicity be fully operational?

The Medicity will develop in three phases. Phase 1 hospitals are expected to become operational by 2027, with the complete medical hub fully functional by 2031. However, property appreciation will begin much earlier as infrastructure development progresses.

Q2) Which areas near Medicity offer the best investment potential?

Properties within 2-5 km of Medicity offer the optimal balance of appreciation potential and current affordability. Eco City Phase 1, Omaxe The Lake vicinity, and emerging developments along the Medicity corridor present excellent opportunities.

Q3) What types of commercial properties will be in demand near Medicity?

Medical retail spaces, diagnostic centers, pharmacies, hospitality facilities for medical tourism, and service apartments for visiting professionals will see highest demand. Expected rental yields range from 12-18% annually.

Q4) How will Medicity impact rental yields in the area?

Current rental yields of 6-7% are expected to increase to 9-12% as healthcare professionals create premium rental demand. Properties closer to Medicity will command higher rents due to convenience factor.

Q5) Is it better to invest in residential or commercial properties near Medicity?

Both offer strong potential, but residential properties provide more security for first-time investors, while commercial spaces offer higher returns for experienced investors willing to accept more risk. A balanced portfolio works best for most investors.

Secure Your Position in New Chandigarh's Medical Hub

The Medicity opportunity won't wait. With construction already underway and prices rising quarterly, 2025 represents the narrow window for maximum returns.

Invest near Medicity and position yourself for extraordinary returns:

Schedule site visits to premium projects near the medical hub

Receive personalized advice on optimal property selection

Access exclusive pre-launch opportunities in the Medicity corridor

Get detailed ROI projections based on medical hub timeline

Don't miss North India's biggest healthcare infrastructure opportunity.

Related Reads

All Projects in New Chandigarh - Complete listings with proximity to Medicity marked

Eco City 1 Development Guide - Detailed analysis of the closest residential hub to Medicity

Commercial Property Investment Guide - Medical retail and hospitality opportunities near healthcare hub

This healthcare hub will significantly impact property values in projects like

Interested in investing? View our current projects.

Planning to buy? Use our EMI calculator and check

available tax benefits.

Comments