New Chandigarh vs Chandigarh: Why Smart Investors are Choosing New Chandigarh in 2025?

- Tanmay Mehta

- Aug 27, 2025

- 8 min read

Updated: Sep 11, 2025

Contents

The Smart Investor's Dilemma

Meet Rajesh Sharma, a 35-year-old IT professional working in Chandigarh's Sector 34. Last year, he made what many considered a bold decision – instead of buying a 3BHK apartment in Chandigarh for ₹1.5 crores, he invested ₹85 lakhs in a premium project in New Chandigarh's Mullanpur. Today, his property is valued at ₹1.1 crores, delivering a 29% appreciation in just 12 months. His smart move was researching New Chandigarh real estate insights before making the investment decision.

Rajesh's story isn't unique. Across the tricity area, smart investors are recognizing a fundamental shift in real estate dynamics. While traditional Chandigarh properties command premium prices due to their established reputation, New Chandigarh offers something equally valuable – exceptional growth potential at accessible price points.

The numbers tell a compelling story. A 1,200 sq ft apartment in Chandigarh's Sector 22 costs approximately ₹1.8 crores, while the same configuration in New Chandigarh's premium localities starts at ₹75 lakhs. This 40-50% cost differential isn't just about affordability – it represents one of India's most promising real estate arbitrage opportunities.

But price alone doesn't drive investment decisions. New Chandigarh's strategic positioning, world-class infrastructure development, and government backing through the New Chandigarh Development Authority (NCDA) create a perfect storm for property appreciation. Industry experts project 60-80% capital appreciation over the next five years, making it one of North India's most lucrative investment destinations.

Head-to-Head Comparison: New Chandigarh vs Chandigarh

Price Differential Analysis

The most striking difference between New Chandigarh and Chandigarh lies in property pricing, where investors can achieve significant cost savings without compromising on quality of life. Understanding these property investment in Mullanpur trends is crucial for making informed decisions.

Chandigarh Property Prices (2025):

Premium sectors (10, 11, 17): ₹12,000-15,000 per sq ft

Mid-tier sectors (20-25): ₹8,000-12,000 per sq ft

Developing sectors (40-50): ₹6,000-8,000 per sq ft

New Chandigarh Property Prices (2025):

Premium townships (DLF Hyde Park, Omaxe): ₹6,500-8,000 per sq ft

Mid-tier developments (Eco City, Marbela): ₹4,500-6,500 per sq ft

Emerging sectors (Ambala Highway): ₹3,500-4,500 per sq ft

This translates to substantial savings: a ₹2 crore budget in Chandigarh secures a 1,600 sq ft apartment, while the same amount in New Chandigarh provides a 2,800 sq ft villa with modern amenities and larger living spaces.

Infrastructure Comparison

Connectivity Advantage:

New Chandigarh's strategic location provides superior connectivity to major transportation hubs:

Airport Access: Chandigarh International Airport is 20-25 km from New Chandigarh vs 15 km from Chandigarh city center

Highway Connectivity: Direct access to Ambala-Chandigarh Highway, Kharar-Banur Road, and upcoming Chandigarh-Ludhiana Expressway

Railway Links: Chandigarh Railway Station connectivity through multiple route options, with proposed rail link to New Chandigarh

Metro Expansion Plans:

The Chandigarh Metro Phase II extension is set to connect New Chandigarh with the main city, featuring:

15 km extension from IT Park to Mullanpur

12 proposed stations covering major residential and commercial hubs

Expected completion by 2027, reducing commute time to 25 minutes

Road Infrastructure:

New Chandigarh boasts wider roads, planned traffic management, and modern infrastructure:

100-200 feet wide arterial roads vs 60-80 feet in older Chandigarh sectors

Dedicated cycling tracks and pedestrian pathways

Smart traffic management systems with sensor-based signals

Lifestyle and Amenities Comparison

Green Spaces and Environment:

New Chandigarh: 40% green cover with planned parks and water bodies

Chandigarh: 35% green cover, mostly in established areas

Modern Amenities:

New Chandigarh developments include clubhouses, swimming pools, and recreational facilities as standard

Chandigarh properties often require additional investments for premium amenities

Investment Hotspots in New Chandigarh

New Chandigarh's real estate landscape is defined by premium developments that combine luxury living with strong investment potential. Here are the key projects in New Chandigarh driving growth in 2025:

Omaxe The Lake - Waterfront Luxury Redefined

Investment Highlights:

Price Range: Starting ₹75 lakhs for 2BHK, ₹1.2 crores for 3BHK

Unique Selling Point: India's first residential project with natural lake frontage

Appreciation Potential: 45% growth recorded in last 18 months

Amenities: Private lake access, water sports facilities, lakeside clubhouse

Omaxe The Lake waterfront homes represents a paradigm shift in North Indian residential development. The project's 50-acre natural lake creates a microclimate that enhances property values while offering residents an unparalleled lifestyle experience.

DLF Hyde Park - Premium Township Excellence

Investment Highlights:

Price Range: ₹85 lakhs to ₹2.5 crores across various configurations

Track Record: 40% appreciation since launch in 2020

Infrastructure: Internal retail mall, international school, healthcare facilities

Rental Yields: 8-10% for commercial spaces, 6-7% for residential

DLF Hyde Park plots showcase DLF's reputation for quality construction and timely delivery, making Hyde Park a secure investment choice. The township's self-contained ecosystem ensures consistent demand from both end-users and investors.

Ambika Group Projects - Diverse Investment Portfolio

Investment Highlights:

Project Range: From ₹35 lakhs plots to ₹3 crore penthouses

Flexibility: Options for plot purchases, independent floors, and luxury apartments

Growth Trajectory: 35% average appreciation across all projects

Strategic Locations: Prime positions along major connectivity corridors

Ambika Group's diversified approach caters to various investment budgets and strategies, from land banking to ready-to-move luxury homes.

Marbela Roice - Twin Towers Landmark

Investment Highlights:

Unique Architecture: Twin tower design creating distinctive skyline presence

Premium Positioning: ₹95 lakhs to ₹1.8 crores for ultra-modern apartments

Smart Home Features: IoT-enabled apartments with app-based controls

Investment Returns: Pre-launch buyers have seen 30% appreciation

The project's innovative design and smart technology integration attract tech-savvy professionals and NRI investors seeking modern living experiences.

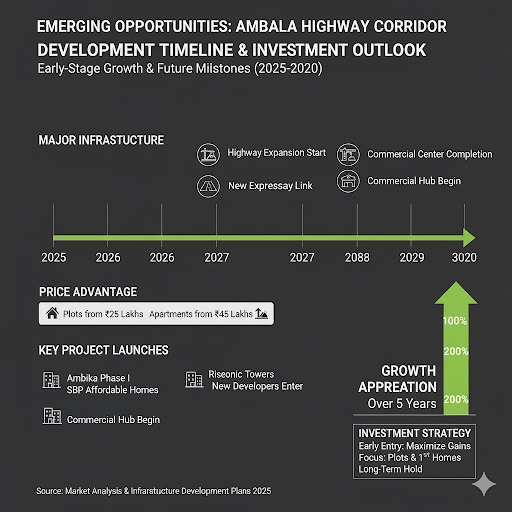

Emerging Opportunities - Ambala Highway Corridor

Investment Highlights:

Price Advantage: Properties starting ₹25 lakhs for plots, ₹45 lakhs for apartments

Infrastructure Development: New highway expansion and commercial development

Growth Potential: Early-stage area with 100%+ appreciation expected over 5 years

Future Growth Catalysts

New Chandigarh's investment appeal extends beyond current developments to encompass transformative infrastructure projects that will reshape the region's economic landscape.

300-Acre Medicity - Healthcare Hub Revolution

The upcoming New Chandigarh Medicity overview represents one of North India's most ambitious healthcare infrastructure projects:

Project Scope:

₹2,000 crore investment in world-class medical facilities

15 specialized hospitals including super-specialty centers

Medical college with 500-bed teaching hospital

Research facilities and pharmaceutical manufacturing units

Investment Impact:

Properties within 5 km radius expected to appreciate 80-100%

Employment generation for 50,000+ healthcare professionals

Medical tourism driving hospitality and service sector growth

The Medicity's strategic location near New Chandigarh ensures that residential properties become highly sought-after by medical professionals, creating sustained rental demand and capital appreciation. Investors looking for residential property for sale in New Chandigarh should prioritize proximity to this healthcare hub.

Education City - Knowledge Economy Driver

Planned Development:

500-acre education hub with multiple universities

Technical institutes and research centers

Student accommodation for 75,000+ students

Faculty housing and academic support facilities

Market Impact:

Student housing demand driving rental yields to 12-15%

Faculty and staff creating premium housing demand

Knowledge economy attracting IT and research companies

Eco City Phase 1 - Sustainable Living Standard

The Eco City 1 developments showcase New Chandigarh's commitment to sustainable urban planning:

Green Township Features:

Solar power integration across all residential units

Rainwater harvesting and waste management systems

Electric vehicle charging infrastructure

Carbon-neutral community design

Investment Advantages:

Government incentives for sustainable housing investments

Lower operational costs attracting environmentally conscious buyers

Premium positioning in luxury market segment

International Airport Connectivity Enhancement

Infrastructure Upgrades:

Chandigarh International Airport expansion to handle 10 million passengers annually

Direct highway connection reducing travel time to 20 minutes

Proposed cargo hub development creating employment opportunities

Real Estate Benefits:

Airport proximity premium of 15-20% for properties

Commercial development opportunities in logistics and hospitality

International connectivity attracting global investment

Expert Investment Advice

Understanding the nuances of New Chandigarh's real estate market is essential for maximizing returns. Before making any investment decision, consult our comprehensive buying property guide for detailed insights.

Best Sectors to Buy in New Chandigarh (2025)

Immediate Investment Sectors:

DLF Hyde Park Area: Established infrastructure, proven appreciation

Omaxe Vicinity: Luxury segment with consistent demand

Eco City Phase 1: Sustainable living trend alignment

Mullanpur Core: Government development focus area

Emerging High-Potential Areas:

Ambala Highway Corridor: Early-stage pricing with infrastructure development

Medicity Periphery: Healthcare hub proximity advantage

Education City Buffer: Academic institution growth beneficiary

5-Year Appreciation Projections

Based on current market trends and infrastructure development timelines:

Conservative Estimates:

Established areas: 45-60% appreciation

Emerging sectors: 80-120% appreciation

Luxury segment: 50-70% appreciation

Optimistic Scenarios:

Premium townships: 70-100% appreciation

Infrastructure corridor properties: 150-200% appreciation

Early-stage investments: 250-300% appreciation

Rental Yield Comparisons

New Chandigarh Rental Yields:

Residential properties: 6-8% annual yield

Commercial spaces: 8-12% annual yield

Student accommodation: 12-15% annual yield

Chandigarh Rental Yields:

Residential properties: 4-6% annual yield

Commercial spaces: 6-9% annual yield

Premium sectors: 3-5% annual yield

Investment Strategy Recommendations

For First-Time Investors:

Start with established townships like DLF Hyde Park

Consider 2-3 BHK configurations for optimal appreciation

Budget allocation: 70% property cost, 30% additional expenses

For Experienced Investors:

Diversify across emerging and established areas

Consider plot investments in infrastructure corridors

Explore commercial opportunities in upcoming developments

For NRI Investors:

Focus on premium projects with international standards

Prioritize locations with easy airport connectivity

Consider property management services for rental optimization

Why 2025 is the Perfect Time to Invest

Several convergent factors make 2025 an optimal investment window for New Chandigarh:

Market Timing Advantages

Pre-Infrastructure Completion Pricing:

Metro extension under construction (completion 2027)

Medicity development in initial phases

Highway expansions creating temporary accessibility gaps

Current prices reflect pre-development valuations

Government Policy Support:

New Chandigarh Development Authority fast-tracking approvals

Tax incentives for sustainable housing projects

Infrastructure investment commitments secured

Smart city initiative funding allocated

Market Maturity Balance:

Sufficient completed projects proving market viability

Premium developers establishing market confidence

Early enough to capture maximum appreciation potential

Quality infrastructure ensuring investment security

Economic Environment Factors

Interest Rate Cycle:

Home loan rates stabilizing at competitive levels

Government initiatives supporting first-time buyers

Developer financing schemes improving affordability

Investment Migration:

NCR market saturation driving investor interest northward

Punjab and Haryana investors seeking growth opportunities

NRI investment increasing in tricity region

FAQs

Q1) What is the average property price difference between Chandigarh and New Chandigarh?

New Chandigarh properties cost 40-50% less than comparable Chandigarh properties. While Chandigarh premium sectors command ₹12,000-15,000 per sq ft, New Chandigarh's premium townships range from ₹6,500-8,000 per sq ft, offering significant cost savings without compromising on amenities or lifestyle quality.

Q2) Which are the best projects to invest in New Chandigarh in 2025?

Top investment opportunities include Omaxe The Lake (starting ₹75 lakhs), DLF Hyde Park (₹85 lakhs to ₹2.5 crores), Marbela Roice (₹95 lakhs to ₹1.8 crores), and emerging projects along the Ambala Highway corridor. Each offers unique advantages based on budget and investment strategy.

Q3) How is the connectivity between New Chandigarh and Chandigarh?

New Chandigarh enjoys excellent connectivity with Chandigarh through multiple highways and road networks. The upcoming Metro Phase II extension will reduce travel time to 25 minutes. Additionally, New Chandigarh offers superior airport access (20-25 km) compared to most Chandigarh sectors.

Q4) What are the expected returns on investment in New Chandigarh?

Conservative estimates project 45-80% appreciation over 5 years, with premium townships and emerging sectors showing potential for 100-200% growth. Rental yields range from 6-8% for residential properties, significantly higher than Chandigarh's 4-6% average.

Q5) Is New Chandigarh suitable for end-users or just investors?

New Chandigarh offers excellent quality of life for end-users with modern amenities, green spaces, and planned infrastructure. Many residents work in Chandigarh but prefer New Chandigarh's spacious homes, cleaner environment, and modern facilities, making it ideal for both end-users and investors.

Ready to Explore New Chandigarh's Investment Opportunities?

Don't let this opportunity slip away. With infrastructure development accelerating and prices still at ground level, 2025 represents a narrow window for maximum investment returns in New Chandigarh.

Book a site visit in Mullanpur today to:

Schedule site visits to premium projects

Receive personalized investment advice

Access exclusive pre-launch opportunities

Get detailed ROI projections for your budget

Join smart investors who are building wealth in New Chandigarh.

Related Reads

Compare All Projects in New Chandigarh - Comprehensive project listings with prices and specifications

New Chandigarh Market Report 2025 - Latest price trends and market analysis

Property Buying Checklist & Legal Guide - Complete step-by-step buying process

This healthcare hub will significantly impact property values in projects like

Interested in investing? View our current projects.

Planning to buy? Use our EMI calculator and check

available tax benefits.

Comments